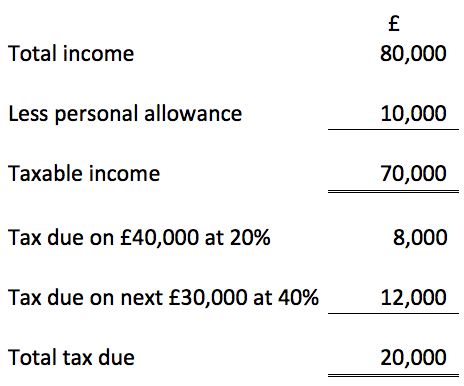

federal individual income tax has a graduated-rate structure with seven tax brackets and rates ranging from 10 to 37 percent. As a result, compared to single-rate taxes, graduated-rate taxes are usually more harmful to economic growth, especially when the variation among rates is large and the top rate is high. This reduces the payoff to additional work and investment on the margin and acts as a negative incentive on working more. Unlike single-rate or “ flat” income taxes, graduated-rate or “progressive” income taxes impose higher marginal tax rates on higher levels of marginal income. Graduated-Rate “Progressive” Income Taxes Typically, this results in a taxpayer’s effective income tax rate, or the percentage of their income paid in taxes, increasing as their income increases. A graduated rate income tax system consists of tax brackets where tax rates increase as income increases.

0 kommentar(er)

0 kommentar(er)